Coverage Ratio What Is It, Formula, Calculation Examples

By doing so, companies can also increase the cash coverage ratio and attract new investors. Based on this information, lenders decide whether they should provide finance to borrowers. By removing non-cash assets from the calculation, stakeholders can get better insights into the company’s resources. Analysts and investors may study any changes in a company’s coverage ratio over time to assess the company’s financial position. Such a situation means that the business cannot pay off its current debts since it cannot generate enough cash flow. A high amount of net cash flow from operating activities results in a higher cash coverage debt ratio.

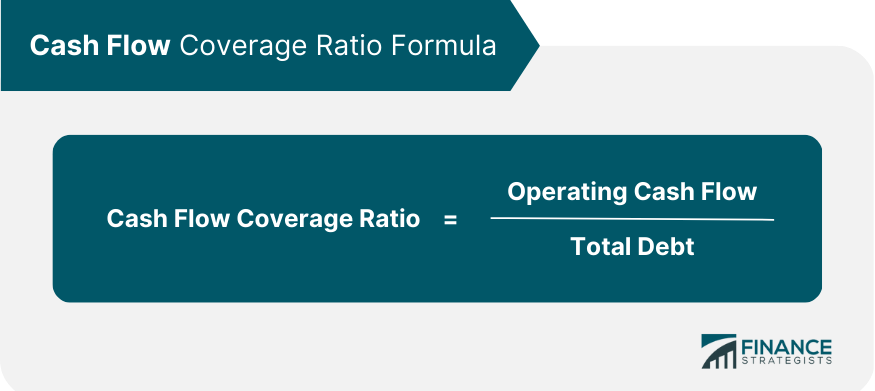

Cash Coverage Ratio Formula & Explanation

While all debt is important when calculating the interest coverage ratio, companies may isolate or exclude certain types of debt in their interest coverage ratio calculations. As such, when considering a company’s self-published interest coverage ratio, it’s important to determine if all debts are included. When a company struggles with its obligations, it may borrow or dip into its cash reserve, a source for capital asset investment, or required for emergencies.

How confident are you in your long term financial plan?

Several coverage ratios look at different aspects of a company’s resources and obligations. The asset coverage ratio only considers a company’s ability to repay debts using total assets minus short-term liabilities. Calculate the current cash debt coverage ratio by extracting the net cash flow from operating activities from the cash flow statement and dividing it by the company’s average liabilities. A coverage ratio indicates the company’s ability to meet all of its obligations, including debt, leasing payments, and dividends, over any specified time period.

What is the formula for calculating the current cash debt coverage ratio?

- Companies with high ratios tend to attract more investors, showing that management is taking proactive steps toward managing their funds responsibly.

- On top of that, some companies may have more obligations while others are lower.

- Creditors like to utilize a cash coverage ratio since it reveals a company’s capacity to pay off debt promptly.

- This indicates how well a company can cover its short-term debts with its liquid assets and indicates how much leverage the company may have over other creditors.

Yes, the interest coverage ratio is the same as the times interest earned (TIE) ratio. These ratios are synonymous; they measure a company’s ability to cover its interest expense with its operating income. Coverage ratios are also valuable when looking at a company in relation to its competitors. Comparing the coverage ratios of companies in the same industry or sector can provide valuable insights into their relative financial positions.

Cash Coverage Ratio Vs. Times Interest Earned: What are the Differences?

The cash coverage ratio is one approach organizations can use to calculate their assets. A ratio of less than 1 means the business would need to use other short-term assets, such as its receivables, to fully pay out its current liabilities. This means that Sophie only has enough cash and equivalents to pay off 75 percent of her current liabilities. This is a fairly high ratio which means Sophie maintains a relatively high cash balance during the year. EBITDA is used in the Cash Coverage Ratio because it represents the cash-generating ability of a company’s core operations. Unlike net income, which can be influenced by non-operational factors like interest and taxes, EBITDA strips out these effects, providing a cleaner view of a company’s operational cash flow.

Significance of the Current Cash Debt Coverage Ratio

For companies that have interest expenses that need to be paid, the cash coverage ratio is used to determine whether the company has sufficient income to cover them. Shareholders can also gauge the possibility of cash dividend payments using the cash flow coverage ratio. If a company is operating with a high coverage ratio, it may decide to distribute some of the extra cash to shareholders in a dividend payment.

Whether the firm is worthy of loans and at what interest rate loan should be provided. Analysts use these ratios to determine the credit rating of the firm. If the ratings are good, then firms get a loan at lower interest rates. It can be used to conduct trend analysis for a company over a period. This calculation shows how its debt-repaying ability is moving over the periods. If it is going down, the firm can have a look at the issue and it can try to rectify that.

Let’s dive into how the account control technology debt recovery and accounts receivable management is used to evaluate the company’s liquidity. They want to see if a company maintains adequate cash balances to pay off all of their current debts as they come due. Creditors also like the fact that inventory and accounts receivable are left out of the equation because both of these accounts are not guaranteed to be available for debt servicing. Inventory could take months or years to sell and receivables could take weeks to collect. The Interest Coverage Ratio is especially useful for evaluating the overall debt burden, including non-cash interest obligations.

KONTAKT Z EKSPERTEM

KONTAKT Z EKSPERTEM

DRUK

DRUK